Helping businesses manage familiar payment methods with greater ease, clarity, and control.

How Check Printing Fits Into the Paywint Platform

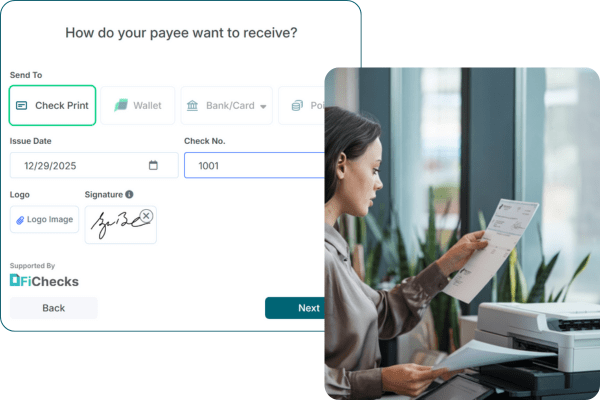

Paywint allows users to create a payment and select check printing as the preferred way for the recipient to receive funds. Once the payment details are reviewed and confirmed, a printable check is generated instantly.

Checks can be printed using any standard printer on regular paper. There is no need for special equipment, pre printed check stock, or outside services. This makes the process straightforward and accessible, whether a business is printing a single check or handling payments as part of its regular operations.

Supporting Day to Day Business Payments

Many businesses still rely on checks for vendor payments, contractor payouts, reimbursements, and internal accounting processes. Paywint supports these needs by keeping check printing available within a centralized digital system.

By handling check payments through the platform, businesses gain better organization, clearer records, and fewer manual steps. This helps teams manage payments more consistently while maintaining the familiarity of a traditional payment method that works with existing workflows.

Built for Flexibility and Control

One of the key advantages of Paywint’s check printing capability is the level of control it offers. Users decide when to print checks and can review all payment details before completing the process.

Because checks can be printed on demand, businesses are not dependent on third party timelines or delivery schedules. This flexibility is especially useful for time sensitive payments or situations where immediate access to a physical check is required.