International Transfers and Recipient Management

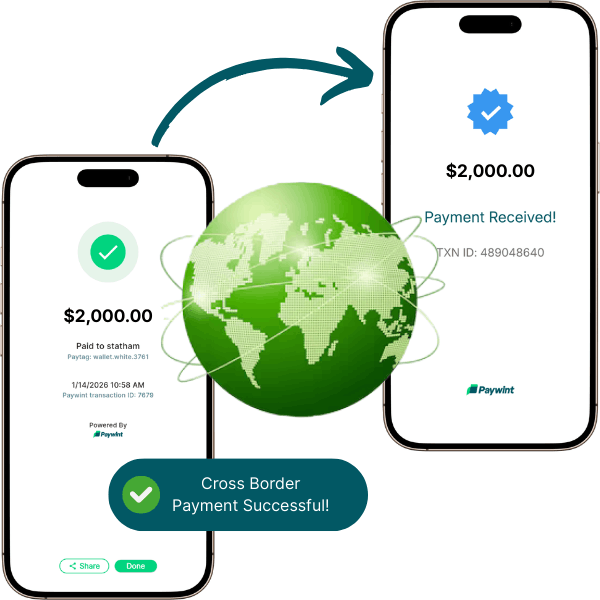

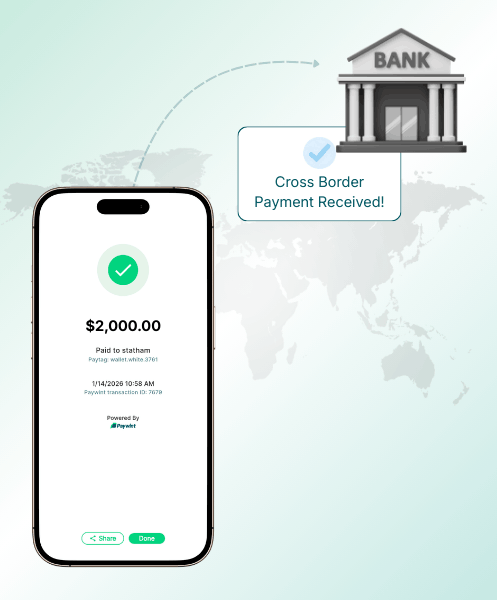

Paywint lets you send money to other countries without any complications. You add your recipients, verify their details once, and manage all your payments from one dashboard. Transfer status updates appear in real time.

Currency Conversion and Payment Options

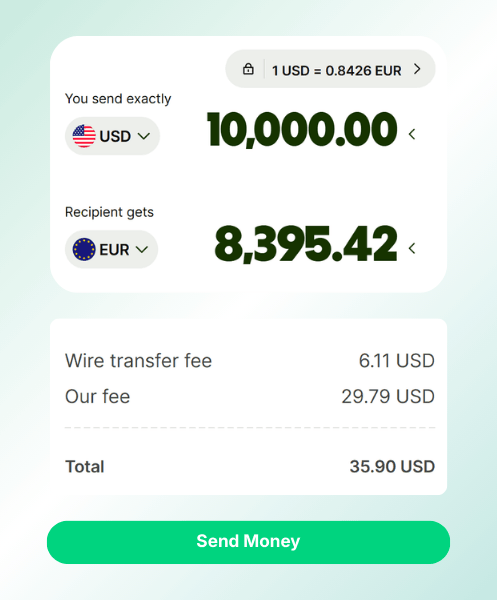

Cross border payments include automatic currency conversion during checkout. Users can pay using cards, bank accounts, digital wallets, and other supported methods. Exchange rates and fees are shown before confirmation.

Secure Processing and Transaction Tracking

Cross border transactions follow secure processing with verification checks. Each transfer includes tracking references and confirmation updates. Your records stay organized and easy to access whenever you need them for reporting or review.

What Our Customers Say

Ethan Carter

"Paywint made it incredibly easy to manage my store and track sales. The reporting tools help me understand what products perform best, and I can adjust my inventory accordingly."

Miles Donovan

"Setting up my online store with Paywint was fast and simple. Now, I can focus on marketing and growing my customer base without worrying about managing orders or tracking stock."

Oliver Bennett

"Running a busy retail shop is tough, but Paywint’s all-in-one tools give me complete control over sales, inventory, and invoices. Everything is organized and accessible from one place."

Frequently Asked Questions

What are cross border payments?

Cross border payments are transactions sent between different countries. Paywint processes these transfers with secure networks and clear tracking. Users can monitor status from start to completion.

How do cross border payment work?

Cross border payment move money through secure financial networks and currency conversion systems. Paywint handles the transfer flow and confirms each step. Funds reach the recipient once the payment is approved and settled.

Are cross border transactions safe?

Yes, cross border transactions are secure. They use trusted financial networks and encryption to keep your money and information protected. Paywint applies fraud monitoring and verification during each step. Users can review logs and confirmations for transparency.

Cross Border Payments vs Traditional Bank Transfers

Cross border payments usually move faster than traditional bank transfers. Bank transfers can drag because the money has to pass through multiple steps before it arrives. With Paywint, you can follow your transfer in real time and always know where it stands.