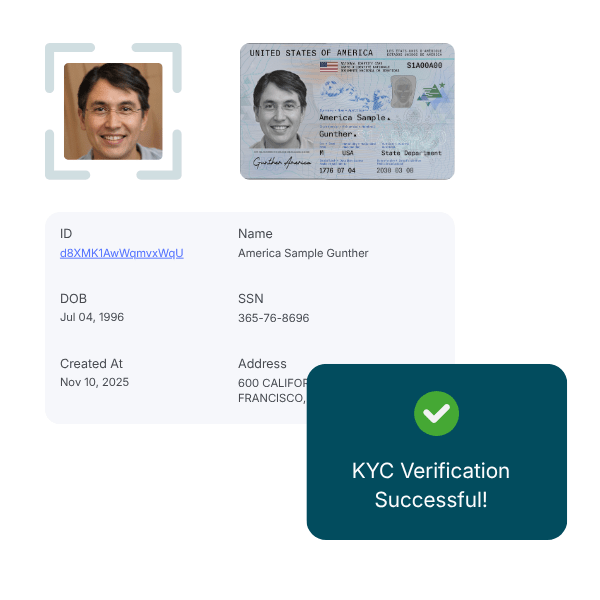

Automated KYC and Fraud Prevention

Paywint’s identity verification service automates the KYC verification process, reducing manual effort and errors. Businesses can confirm customer details instantly and prevent fraud with accurate data checks and secure authentication methods.

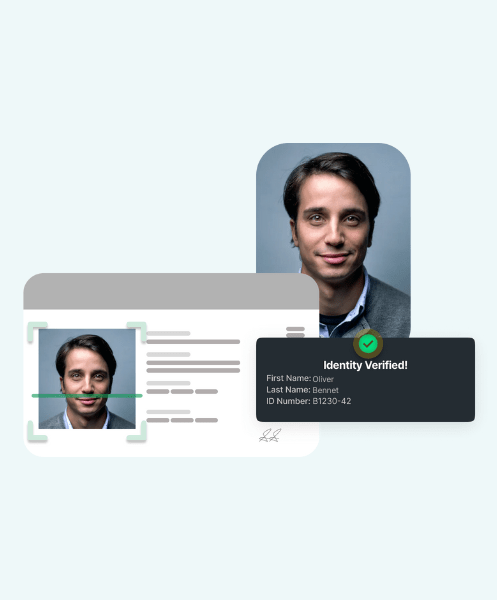

Real-Time Identity Verification Solutions

Paywint provides identity verification solutions that validate ID documents, photos, and biometrics in real time. The system ensures fast approval without compromising security and makes sure only verified users complete payments or open accounts.

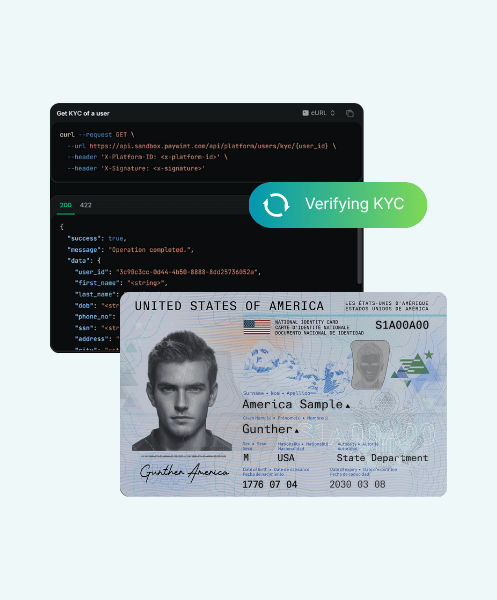

Easy Integration with Financial Systems

Paywint’s KYC verification service connects easily with banking and fintech platforms. It supports automated workflows, instant verification results, and continuous monitoring for regulatory compliance.

What Our Customers Say

Ethan Carter

"Paywint made it incredibly easy to manage my store and track sales. The reporting tools help me understand what products perform best, and I can adjust my inventory accordingly."

Miles Donovan

"Setting up my online store with Paywint was fast and simple. Now, I can focus on marketing and growing my customer base without worrying about managing orders or tracking stock."

Oliver Bennett

"Running a busy retail shop is tough, but Paywint’s all-in-one tools give me complete control over sales, inventory, and invoices. Everything is organized and accessible from one place."

Frequently Asked Questions

What documents are required for identity verification?

Most verification processes require a government-issued ID, such as a passport or driver’s license. Paywint’s system automatically validates these documents during KYC verification.

How long does the KYC verification process take?

With Paywint, the process takes only a few seconds. The KYC verification service checks user data and verifies authenticity instantly through automated systems.

Can businesses prevent fraud using verification software?

Yes, Paywint helps detect fake or altered documents through advanced AI-based verification solution. It prevents fraudulent activities and ensures only verified users complete transactions or open accounts.

Identity Verification vs Manual Verification

While manual verification relies on human reviews and paperwork, automated identity verification confirms users' identities using all digital means in the shortest and most efficient way. Without delay, it cuts down on errors and truly guarantees compliance with regulations through real-time automated KYC verification.