Enhanced Verification, Faster Onboarding, and More Secure Financial Data Access Through Plaid’s Trusted Connectivity Network.

Why the Partnership Matters

In today’s fintech landscape, dependable data connectivity is essential for platforms that handle payments, transfers, and financial identity verification. Users expect a fast and secure way to link their bank accounts without the delays or complications associated with manual verification. Businesses and developers also depend on accurate, real time account information to maintain smooth financial workflows.

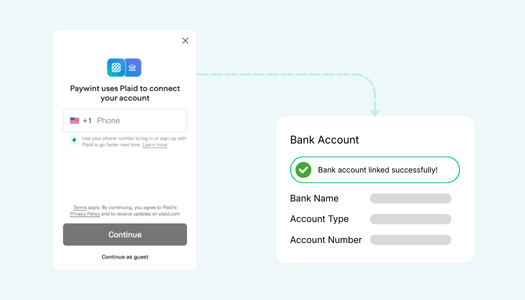

Paywint’s integration with Plaid addresses these expectations by offering a modern, streamlined method for gathering verified banking information. The partnership strengthens Paywint’s broader mission to simplify financial access while building systems that support clear, uninterrupted user experiences.

Enhanced Verification and Faster Onboarding

Plaid’s technology introduces a higher level of precision during account verification. Instead of requiring manual data entry or document uploads, users can authenticate their bank information through a guided, secure flow. This reduces the risk of errors and helps users complete onboarding in significantly less time.

For businesses that rely on real time financial validation, the benefits are even more apparent. The improved accuracy and reduced friction support faster activation of financial services, smoother account setup, and better oversight of user activity. This ultimately contributes to a more responsive and professional onboarding process.

Strengthening Payment Infrastructure

Stronger bank connectivity directly improves Paywint’s payment systems. With Plaid’s data access tools, users can link financial accounts in a way that supports quicker transfers, smoother reconciliation, and more dependable transaction workflows. When financial information is delivered securely and in real time, payment operations become more consistent and predictable.

This enhancement aligns with Paywint’s commitment to building an advanced financial operations platform. A stronger payment infrastructure benefits both individual users and businesses that depend on consistent, uninterrupted financial activity.