Enabling Seamless Payment Automation, Account Connectivity, and Real Time Transaction Management.

Why API Integration Matters in Modern Finance

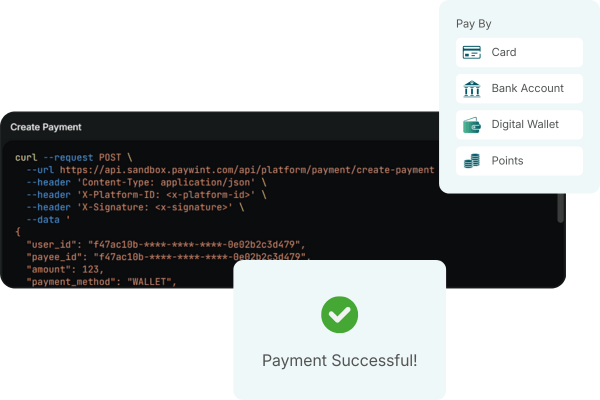

In today’s digital economy, businesses require systems that offer speed, reliability, and automation. API integration plays an essential role by allowing different platforms to communicate seamlessly. Instead of relying on manual transfers or switching between separate banking portals, businesses can automate workflows, reduce human error, and gain real time visibility into their cash flow and transactions.

By embedding Paywint’s API into existing systems, companies remove friction from daily operations. This ensures consistent financial data, instant payment processing, and simplified account management. These capabilities are especially important for businesses that operate at scale or manage a high volume of transactions.

Key Capabilities of Paywint’s API Integration

Paywint’s API provides a strong suite of features built for modern payment and account management needs:

Automated Payments and Transfers

Businesses can trigger payouts, settlements, and collections automatically. This allows companies to streamline cash flow, manage vendor payments, handle refunds, and support other financial operations without manual input.

Real Time Account Connectivity and Balance Monitoring

Connected systems receive updated account balances, transaction histories, and payment statuses in real time. Finance teams benefit from current information that supports faster decision making and accurate reporting.

Secure Data Handling and Compliance

The API uses encrypted communication and secure authentication. Paywint maintains strict compliance practices to protect sensitive data while enabling fast and reliable financial operations.

Automated Account Management and Reconciliation

For companies with multiple accounts or complex payment flows, Paywint’s API supports automated reconciliation. This reduces administrative work, keeps transaction records organized, and provides a clear audit trail.

Scalability for Growing Businesses

The API is built to support increasing transaction volumes. Both small businesses and large enterprises can rely on Paywint’s infrastructure as they grow without worrying about performance issues.

Benefits for Businesses and Developers

Integrating Paywint’s API provides clear advantages for businesses and development teams:

Reduced Operational Workload

Automation minimizes manual tasks, lowers error rates, and frees internal teams to focus on higher value responsibilities.

Improved Cash Flow Control and Financial Insight

Real time reporting and consolidated data give companies greater clarity and confidence in their financial decisions.

Faster Launch of New Financial Features

Software platforms and marketplaces can add payment and banking capabilities quickly by using Paywint’s API, which avoids the need to build financial infrastructure from the ground up.

Enhanced User Experience

End users benefit from smoother payment flows, faster processing, and integrated financial workflows that improve satisfaction and retention.