How FedNow Transforms Payment Experiences

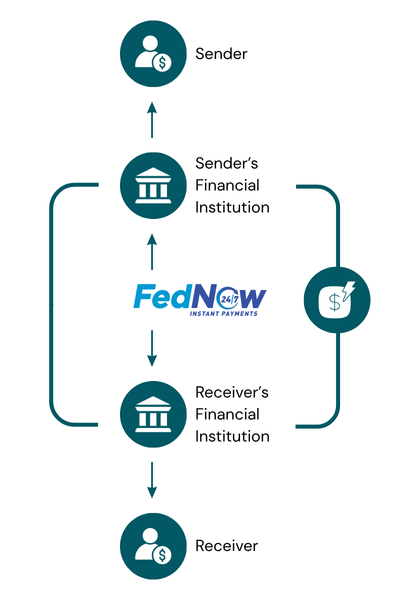

FedNow has redefined how money is moved in the United States. It eliminates delays that come with traditional transfers and ensures instant credit to the recipient’s account. For businesses using Paywint, this means no more waiting periods or processing times. Every transaction becomes immediate, improving efficiency and customer satisfaction in the process.

Why Businesses Choose Paywint for FedNow Integration

With the FedNow integration, Paywint offers secure, stable, and developer-friendly access to instant payment infrastructure. Paywint makes onboarding easier for banks, fintechs, and enterprise set-ups with minimal changes in the current architecture. From compliance handling to monitoring a transaction, Paywint makes leveraging the full potential of instant payments easy.

Benefits of Real-Time Payments

FedNow puts businesses more in command of their liquidity, reducing delays in operations. Instant settlement of money strengthens your relationships with vendors and builds trust with your customers. Paywint makes it even better with complete visibility into the tracking of each transaction, seamlessly integrating with other financial tools. This leads to fast, smart, responsive payment ecosystems.

What Our Customers Say

Ethan Carter

"Paywint made it incredibly easy to manage my store and track sales. The reporting tools help me understand what products perform best, and I can adjust my inventory accordingly."

Miles Donovan

"Setting up my online store with Paywint was fast and simple. Now, I can focus on marketing and growing my customer base without worrying about managing orders or tracking stock."

Oliver Bennett

"Running a busy retail shop is tough, but Paywint’s all-in-one tools give me complete control over sales, inventory, and invoices. Everything is organized and accessible from one place."

Frequently Asked Questions

What is the purpose of FedNow?

FedNow is designed to enable real-time payments across financial institutions, allowing instant transfers at any time. Paywint lets businesses connect seamlessly into this network so they can offer immediate payment capabilities conveniently to their customers.

Is FedNow available to all banks?

Participation in FedNow depends on whether a financial institution has joined the network. Paywint works with its partnered institutions and fintech customers to integrate with participating banks so that they can begin sending and receiving payments immediately.

How secure is FedNow for business transactions?

FedNow uses robust authentication and encryption standards to protect every transaction. Paywint enhances this security framework by adding more fraud-detecting tools and compliance systems so that every payment will be safe and traceable.

FedNow vs ACH Transfers

FedNow processes payments in real time, giving users instant access to their funds, while ACH processes transactions in batches that can take one to two business days. ACH operates only during business hours, but Paywint’s secure integration allows businesses to go beyond these limitations and experience the reliability and convenience of continuous, around-the-clock payments.