Overview of Financial Crimes in Online Payments

When you consider the wider pool of online payment processing support, there are plenty of options to aid in your financial operations. Before we delve deeper into the topic of KYC implementation, the first step is to understand the range of crimes committed across the fintech domain. Most digital or technology-oriented fintech issues are connected to fraud, scams, and related activities. AI and deepfake issues are rising vehemently in the niche. Global fraud rings and rackets operate across several platforms, giving rise to multiple fintech management issues. Illicit transactions and ineffective payment support at organized rates are on the rise. Crimes and mishaps occurring in the fintech domain could prove critical in eroding consumer trust. Once a business loses its audience’s goodwill, it could result in eventual collapse. It is where the need for overcoming financial crimes in online payments can be systematically understood and comprehensively taken care of.

Why Dynamic KYC Solutions Matter for Online Payments Support

With the type of risks being faced by the fintech model and considering the pace of those attacks, it is significant to step away from traditional measures in KYC support. The verification and documentation of the Know Your Customer (KYC) processes should shift to a proactive model. Fintech and digital domain criminals are capable of bypassing regular security and wreaking havoc on the defined confidentiality and privacy of operating models. This could disable trust and integrity expected from standard business models. For monetary transactions to be on their guard consistently and without fail, dynamic KYC is a must. Also known as perpetual KYC (pKYC), this approach is a notch above the regular templates and periodic processes. Proactive data updates and resetting of existing KYC norms are possible with this model. Such enhanced security solutions could be useful in optimizing costs, reducing failures, and empowering operational efficiency of the business.

Top Benefits of Employing Dynamic KYC for Online Payments

The introduction of dynamic KYC parameters can enhance your overall payment support and transactional value. Below are a few main advantages of embracing pKYC for US small and medium businesses:

- Real-time Monitoring

- Structured Payments Model

- Enhanced Customer Experience

- Cost Effectiveness

- Integrated Business Value

Major Components of Dynamic KYC Solutions

Employing pKYC can offer authentic support in adopting an empowering online payments process. The top components to create value in such use cases are listed here for your reference:

- Implementation of AI Agents – With AI agents, businesses can track, record, and verify data points related to financial risk reports. It is done with automated metrics and workflow.

- Transactional Behaviour – This is the component that observes and recognizes the change of course in established and legitimate financial transactions.

- End-to-End Risk Monitoring – Money movement can be strategically understood and analyzed with a one-stop risk monitoring model. Dynamic KYC processing allocates space for businesses to screen global databases for any anomalies and issues.

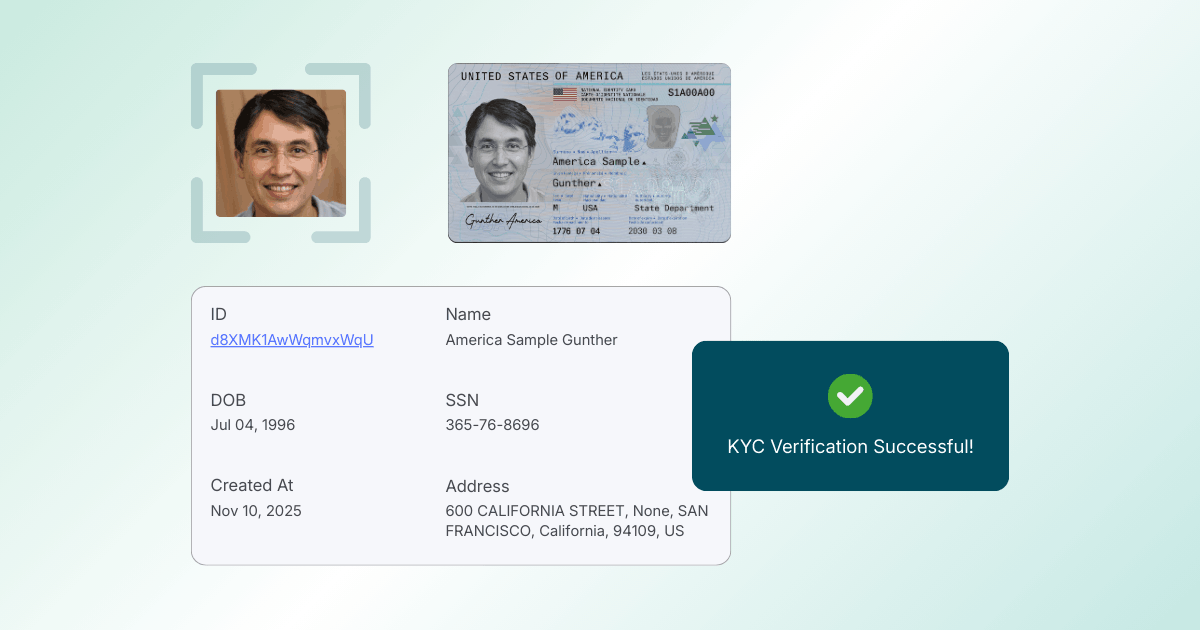

- Advanced Digital Verification – You have the option to carry out digital identity verification of customers and enable the monetary transactions in the business environment with a promising, risk-free procedure.

- Strategic Regulatory Checks – The option to check and optimize the fintech environment of a business based on valid compliance norms and regulatory measures is feasible in this system.

In A Nutshell: Paywint & Dynamic KYC in Online Payments

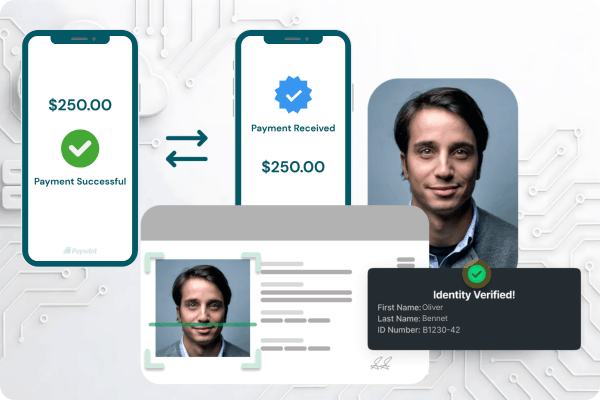

Fintech ecosystem operators like Paywint demonstrate a proven track record in implementing dynamic KYC solutions to carry out digital and online transactions. Small and medium businesses in the USA can make use of this specific business model to ensure optimum quality in the resolution of financial crimes feasibly. It helps business models to analyze and detect fraud with high risks and malicious intent. Customer trust and compliance management will be much more feasible for businesses while aligning with a top-notch pKYC model.