High Risk Merchant Account

High Risk Merchant Account services from Paywint provide secure, scalable, and stable ways of processing payments without interruption. For businesses that are often considered high risk, Paywint approves accounts quickly, processes payments securely, and gives business owners peace of mind.

Payment Freedom for High-Risk Businesses

Paywint provides 100+ high-risk businesses with secure, low-cost payment processing. Get rapid approvals and anti-fraud protection to accept payments securely free of mainstream bank roadblocks.

Multiple Payment Options

Accept payments securely online, in person, or by phone.

Simplified Subscription Billing

Automate subscriptions effortlessly with built-in recurring billing tools.

Chargeback Protection

Prevent chargebacks with real-time monitoring and early dispute alerts.

Flexible Payment Solutions for High-Risk Merchants

Paywint merchant account is not only processing. It also comes with fraud defense, chargeback protection, and approval optimization to continue having transactions process effectively.

Credit Card Processing

Accept credit and debit cards instantly.

ACH Processing

Secure payments from customer bank accounts.

AI-Powered Fraud Detection

Detect and prevent fraud with advanced AI tools.

Payment Gateway Integration

Connect with trusted gateways for smooth checkout.

Approval Rate Optimization

Increase revenue with higher approvals.

Chargeback Protection

Prevent and manage disputes effectively.

Seamless Payment Processing With Full Protection

Paywint streamlines managing transactions for high-risk companies. As a high-risk merchant account, you receive built-in fraud protection, chargeback notifications, and compliance filtering. Our system protects every payment, letting you grow your business without worrying about risk

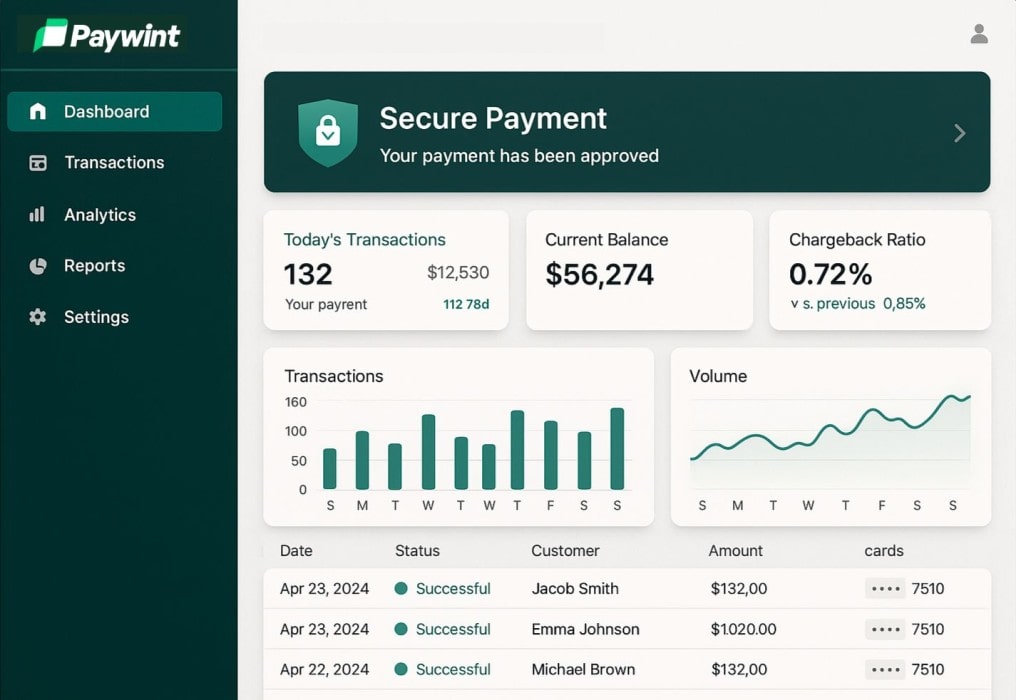

Reliable Dashboard and Ongoing Support

It’s simple to keep payments in line with Paywint’s real-time dashboard. Businesses using a merchant account can monitor payments in real time, check how well their business is performing, and receive assistance whenever they want it. From sign-up to business operations, the platform keeps everything running smoothly.

Get Your High Risk Merchant Account in 3 Simple Steps

Apply Online

Fill out a fast and secure application with your business details.

Get Approved

Our team manually analyzes your profile and gives quick approval specific to your business sector.

Start Accepting Payments

Integrate with our platform and begin processing credit cards, ACH, and more right away.

Frequently Asked Questions

What is a high risk merchant account and why is it needed?

High risk business account is for businesses that fall into high-risk categories with increased chargeback and fraud potential. Paywint is one such business that provides such businesses secure approvals, fraud monitoring, and smooth payment processing most well-suited for high-risk needs.

What makes me qualified for a high risk merchant account?

Eligibility is based on your industry sector, transaction history, and business type. Paywint simplifies it by assisting the applicant, complying, and creating a high risk business account that suits their needs.

Are high risk merchant accounts safe for online payments?

Yes, it is possible for a high risk business account to be highly secure if backed up by fraud protection and strong encryption. Paywint makes sure business accept payments securely, and this means both the merchants and customers trust each transaction.

High Risk Merchant Account vs Standard Merchant Account

High-risk merchant account offers several levels of security, quicker approval for high-risk businesses, and enhanced fraud protection compared to regular accounts. While low-risk accounts for low-risk businesses, high-risk solutions provide longer compliance and transaction security.